Our mission is to teach a proven system and to provide traders with the tools to master it.

Peter Stolcers, founder

Your Success Is All That Matters

If you want to learn how to trade, you’ve come to the right place. It won’t be an easy journey, but we have everything you need. Our members are living proof that this system can be learned and replicated.

Others have gone through the process and so can you.

Review these testimonials from members who have learned our system and dramatically improved their win rate. Click on their photos and see what they have to say. Click here to refresh for new testimonials.

Here's What We Traded Recently

This is a simplified preview of our chat room last week. Notice that many traders are posting great stocks and the action is widespread. We are a laser-focused community trading a systematic approach.

@JJohnson: PEP trying to buck the trend and go up View

@Nodakk: Still below yday close, D1 is nearly linear down...better choices out there. · @JJohnson: PEP trying to buck the trend and go up View

@bb_co: I am liking WDC for short View

@RogerT: Gosh.. its so compelling to short it rn · @bb_co: I am liking WDC for short View

@spectre: sounds like a great time to set an alert! The market isn't doing anything and it's right on top of the SMA 200. WDC is making a very steep move lower and moves like that don't typically keep going ... View

@RogerT: The daily chart looks crazy.. · @JJohnson: PBR looks rs View

(Strong on D!, broke above 100 SMA)

@paladin: Question in regards to reddit post on journaling, which service is good to use to review trades, i know there have been a few mentioned, but i can't remember their names, thank you View

@Tech tok: Question @Pete when the market transitions from a bull market to a bear market, does it ALWAYS result in a double top lower high or is it highly probable? The reason I ask this is, why wouldn't we kee... View

@Khorn: No one has mentioned this yet and I think it is important. The market is finding resistance right now at that previous election gap. View

@JJohnson: DHI looks strong but the volume is not great View

@Hariseldon: Exit TSLA with $1 Profit per share - (1,000) - saw a quick opportunity there, had to take it View

@Photon: Hari, Can you please help me understand how you identified the opportunity to scalp? · @Hariseldon: Exit TSLA with $1 Profit per share - (1,000) - saw a quick opportunity ... View

@Hariseldon: After consolidating it broke below and headed to VWAP · @Photon: Hari, Can you please help me understand how you identified the opportunity to scalp? ... View

@SpecRacing: If the answer is "if you're not an expert trader" no need to respond, but i assume the rest of us would have wanted to wait for a drop below VWAP and then confirmation? · ... View

@ExpectationValue: Question The market seems to be pricing in a 0.35% move today. THe ATM SPY straddle is available for just $2. Is that because there is no market mover for the day with news etc... View

@lilsgymdan: just bagged a 50% profit on a $113 UPS straddle 110 was my target View

if the market does something though it could come back to 115

There are some OK longs to try, but tbh nothing I'm very excited about. There's no market tailwind today and I'm not a fan of trading against my longer term bias (bearish) without some sort of intraday market tailwind.

I personally trade the best when I feel that I can be flexible and/or the conditions are ripe for trading with size. I don't have either of those two here, so I'm just waiting. If buyers can hold the SMA 200 today and start adding to the breakout tomorrow, I can day trade the long side with confidence. If longer term sellers start to show signs of aggression, there's plenty of move to the downside now that we've had a reasonable bounce so I don't need to worry about rushing. The second mouse gets the cheese

@Dave W: LPTE now there should not be a lot of trades being taken imho View

@Hariseldon: Might want to take the "h" out of that imho there.... · @Dave W: LPTE now there should not be a lot of trades being taken imho View

@Dave W: trying to differentiate my self from Hari lol · @Hariseldon: Might want to take the "h" out of that imho there.... · @Dave W: LPTE now the... View

@JaxTrader: Question We ok to post strangles and straddles here? View

I didn't know it would bounce that high, but I figured it would bounce because 1) very steep selloffs like that are not sustainable without major news 2) no market tailwind means you can probably get in at a better point and 3) look at aM15 chart of WDC. Every time it has a steep drop, it bounces back up. It's in a fairly wide M15 bearish trading channel, and the price action reveals that

@RogerT: Gosh.. its so compelling to short it rn · @bb_co: I am liking WDC for short View

@spectre: just got a LRSI < 0.8 alert triggered. Hope you set an alert and are glad you didn't take the trade at the LOD :) · @RogerT: Gosh.. its so compelling to short it... View

@RogerT: Yes.. didnt short it then. Lets short it now? · @spectre: just got a LRSI < 0.8 alert triggered. Hope you set an alert and are glad you didn't take the trade at the LOD :)... View

@RogerT: Yes.. didnt short it then. Lets short it now? · @spectre: just got a LRSI < 0.8 alert triggered. Hope you set an alert and are glad you didn't take the trade at the LOD :)... View

@RogerT: Yes.. didnt short it then. Lets short it now? · @spectre: just got a LRSI < 0.8 alert triggered. Hope you set an alert and are glad you didn't take the trade at the LOD :)... View

@bitbean: Exit ABBV @$201.55, 1.11 profit (forgot a B in the entry post sorry) View

@Hariseldon: Have to head out for the rest of the day - happy hunting! View

@Pete: Getting ready to short /ES if we blow thru 200-day. View

@Mokki: Feedback Request Since SPY just crossed above its 200 day SMA, I was thinking of employing the figleaf strategy as described in the wiki -- where one buys a deep ITM Call on SPY and sells calls agains... View

@Crunchy: MRK dropping again after after a bounce. I don’t see much resistance until 81.05, feb 18 candle View

@lilsgymdan: RFK also would like to ban ads on tv for pharma View

@Waffles: As a healthcare professional I agree with that · @lilsgymdan: RFK also would like to ban ads on tv for pharma View

@JJohnson: Exit Long DASH 197.64 $2 loss View

@Pete: Exit /ES for 2 pt gain. Just not getting the push lower I need to see. Getting late in the day and now I will just wait to see what happens. View

@RogerT: Are you planning to keep TGT overnight? :) · @Pete: Exit /ES for 2 pt gain. Just not getting the push lower I need to see. Getting late in the day and now I will just wait... View

@RogerT: Are you planning to keep TGT overnight? :) · @Pete: Exit /ES for 2 pt gain. Just not getting the push lower I need to see. Getting late in the day and now I will just wait... View

@BigUzi: absolutely not trying to call you out or anything, but every question i've seen from you in the last few days has been about managing trades other people have taken or just like looking for advice. i ... View

@H.S. Wren: Question Very strange, but my TV chart shows the daily SMA in a different place. I've tried just about every adjustment to get it to match OSP and TOS and it still displays the same. Anyone else use T... View

@Photon: Good trade man :) · @Tobias: Back. Nice TSLA now $286.52 :-) Worked. View

@ShKalash: I'm heading out early, So have a great evening Everyone.Here's my chart for ABBV today. This was an almost perfect daytrade in this environment. This is the kind of PA we dream of, so I'm posting thi... View

@FW: I don't see the issue on TV. Have you tried clearing the cache? "Settings > Service > Clear Cache" · @H.S. Wren: Question Very strange, but my TV chart shows the daily SMA ... View

@H.S. Wren: Question Very strange, but my TV chart shows the daily SMA in a different place. I've tried just about every adjustment to get it to match OSP and TOS and it still displays the same. Anyone else use T... View

@FW: I don't see the issue on TV. Have you tried clearing the cache? "Settings > Service > Clear Cache" · @H.S. Wren: Question Very strange, but my TV chart shows the daily SMA ... View

@H.S. Wren: What is the SMA indicator you are using? I don't believe that it is the standard. I've tried clearing the cache and using multiple different SMA indicators and it still displays the same. ... View

@BigUzi: Question Where should we set stops on a popbull or popbear entry swing trade? would you say if the trade goes back into the D1 compression that it should be closed? View

@H.S. Wren: What is the SMA indicator you are using? I don't believe that it is the standard. I've tried clearing the cache and using multiple different SMA indicators and it still displays the same. ... View

Long Short DLTR time spread

Exit Long TSLA $286.23

Short TGT 105.22

Exit Long CVS - $2.20 loss per contract - i knew i liked walgreens better anyway

Exit /ES for 2 pt gain. Just not getting the push lower I need to see. Getting late in the day and now I will just wait to see what happens.

Exit Long DASH 197.64 $2 loss

Long TSLA $281.82 (smaller position)

Exit Short SBUX $95.00

Exit Long TSLA $281.28

Short /ES 5814. What's different now? The last bounce made a lower high and it did not get back to VWAP. That increases my odds that they will take out the lod and hunt for stops. No guarantees, just better odds of it.

Long TSLA $280.24

Exit Long NFLX 994.15 for $2 profit

Short TGT $104.75

Exit Short /ES 5814 for 7 pt gain

Exit ABBV @$201.55, 1.11 profit (forgot a B in the entry post sorry)

Exit MRK with .90 profit per share (1,000)

Short /ES 5821. I have a lower high and another breach of VWAP. This is likely a day trade unless we tank thru the 200-day MA (unlikely)

Exit Long FCX took 50% profits in UOA trade from last week

Short ABBV @ $202.66

Short NKE at$66.57

Short MRK $88.55 - 1,000 Shares

Short SBUX - 95.58 - added to my position - paper

PAPER Exit UPS $110.09 $.50 gain

PAPER Short UPS $110.59 Market testing/bouncing at vwap, and stock incredibly weak.

Long GOOG @172.47

Exit TSLA with $1 Profit per share - (1,000) - saw a quick opportunity there, had to take it

Short TSLA $277.67 - 1,000 Shares

Short SBUX $95.84 (adding to short from yesterday)

Exit Long BLK $974.22 (from yesterday)

Exit JPM for tiny profit. D1 looked good, but it's not strong on M5

Long DASH 199.66

Short CF - $74.60

Exit Long AMZN took profits

Long SPOT - 620 - paper

Long AMZN

Long META 632.45

Exit Short LVS 41.19 @PhilMyOrder: Short LVS 41.35 View

Long MSTR - 338.26 paper

Long MSTR 339.56

Long NFLX 992.14

Long NFLX 990.51

Long JPM $249.51. (Strong on D!, broke above 100 SMA)

Long CRWD 390/392.50 CDS for $1.20

Long CRWD - 389.50 - paper

Exit Long HIMS - 38.59 - big profit - paper - trade whats in front of you and don't anticipate

Grouped By Trader

Notifications

your_Username

Active

Resources

Bookmarked Messages

Daily Bulletins

New Features On Option Stalker Pro

Advance Your Trading With Modern Tools

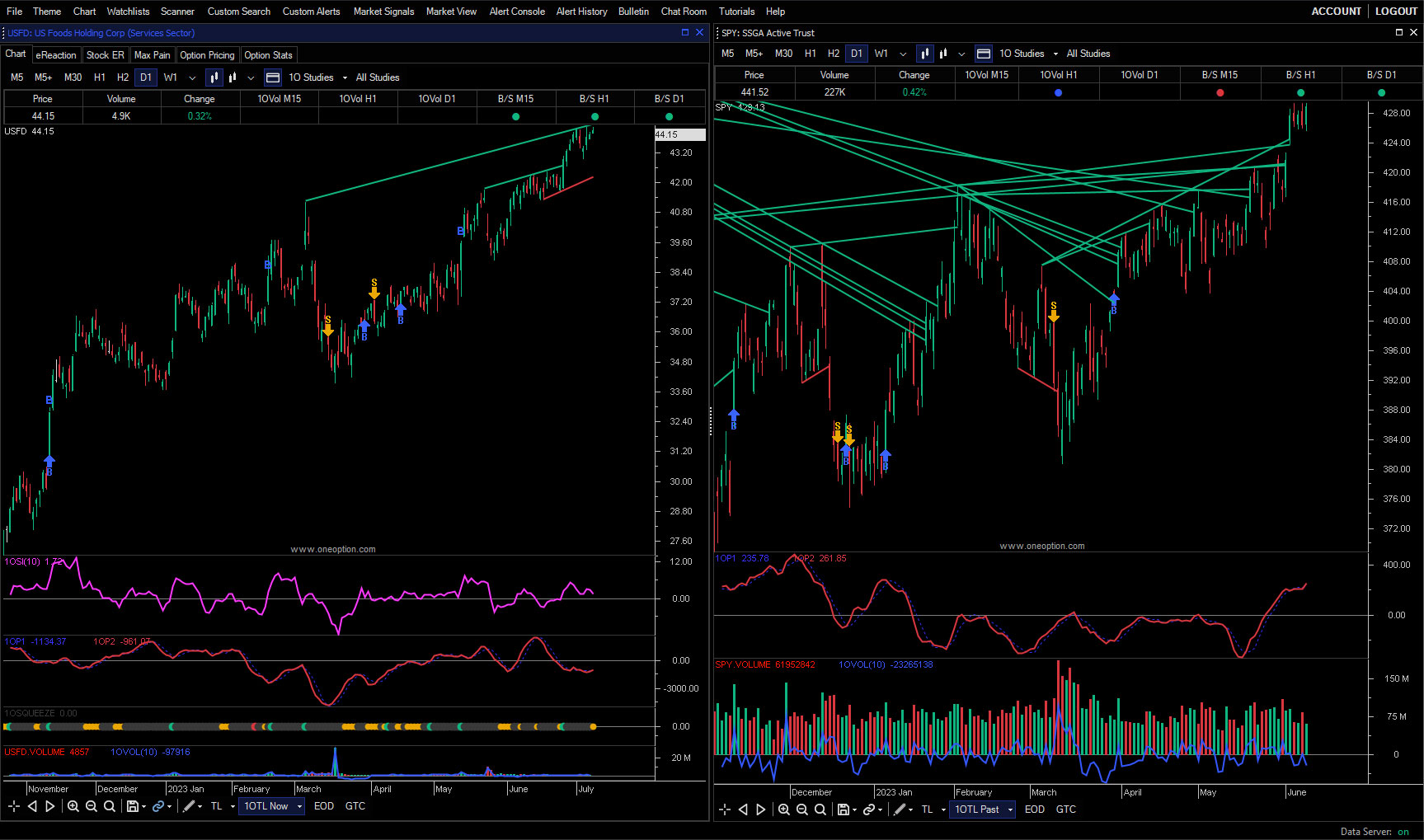

Trade Our Buy & Sell Signals

Your confidence will grow with each positive outcome.

After years of refinement, we've taken our 1OP Indicator to the highest level. It now produces accurate buy and sell signals across multiple time frames. They are available in Option Stalker and Option Stalker Pro. View the arrows on the charts, use the trade signals as a variable in your searches and set alerts for them to improve your entries and exits.

We took random symbol requests during this one hour live event. Watch it now and gauge the accuracy. This article explains how to trade these signals.

Don't trust any promotional hype. Watch the video, read the article and them test them yourself during the free two week trial. You'll be amazed at how well they work.

Automated Trendlines

Introducing our game-changing feature: Automated Trendlines. Say goodbye to manual chart drawing and hello to precision trading. With our cutting-edge rules, Option Stalker Pro automatically draws key trendlines on daily stock charts to help you track key levels of support and resistance monitored by institutional investors. Experience the ease and effectiveness of effortlessly tracking these levels to stay in sync with the Smart Money to advance your trading potential.

Rich Indicator Alerts

Experience the power of Rich Indicator Alerts, the ultimate tool for optimizing your trade entry and management. With this groundbreaking feature, you have the ability to create custom alerts based on stock indicator values, tailored to your unique trading strategy. Set up alerts that trigger on advanced indicator values, allowing you to stay one step ahead of the market. Whether it's multiple rules or multiple symbols, this feature offers unparalleled flexibility. Build alerts effortlessly from a list or chart, empowering you to closely track a stock and patiently wait for the perfect conditions to align and take control of your trading success like never before.

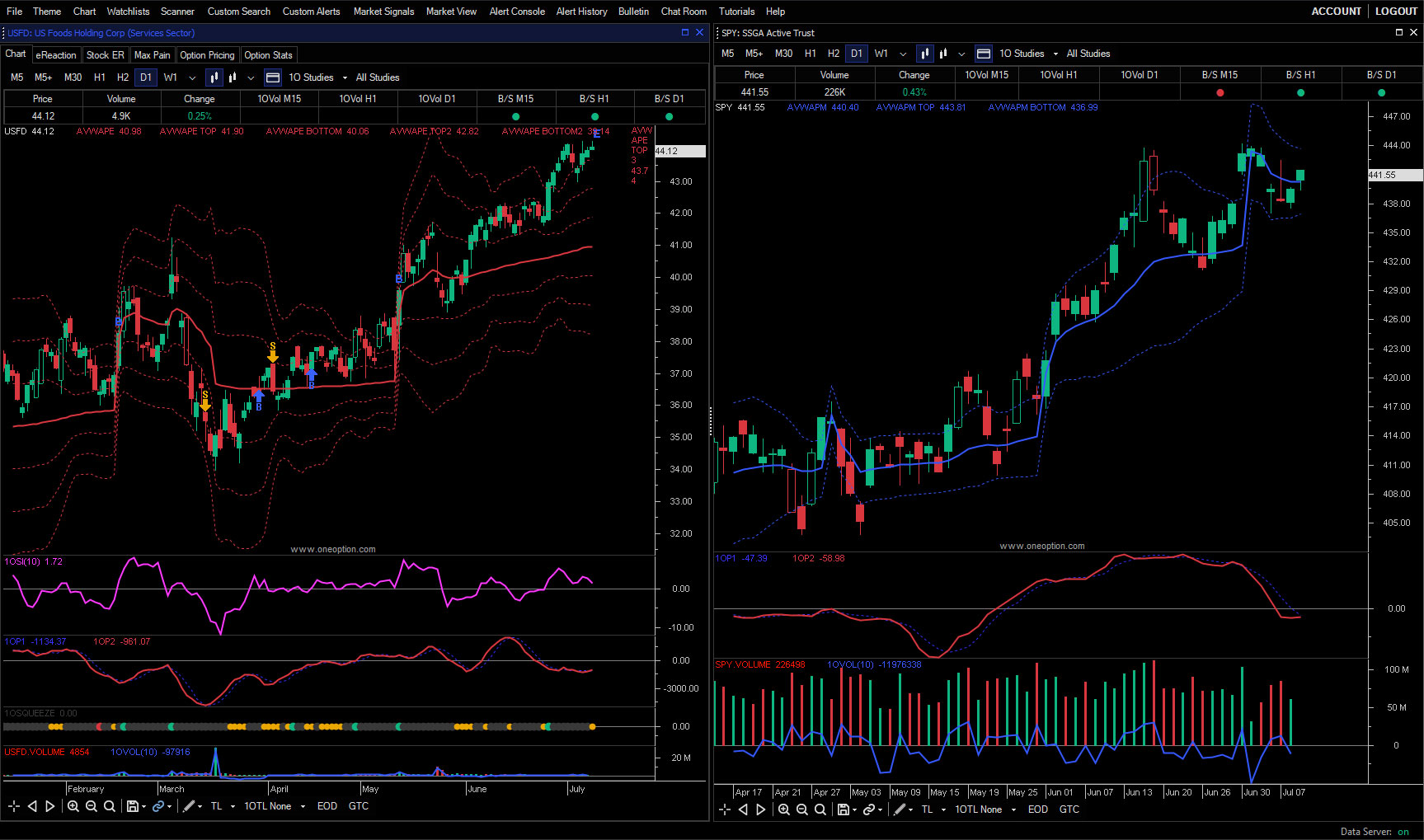

AVWAP Institutional Analysis

Stay ahead of the game and make informed trading decisions by harnessing the insights provided by AVWAP. This indicator, Anchored Volume Weighted Average Price, allows you to anchor VWAP at custom locations or significant dates, such as the start of the month, quarter, or earnings releases. By doing so, you gain access to crucial price levels closely monitored by institutional investors. For day traders who track institutional money and seek to capitalize on relative strength and weakness, these price levels are indispensable considerations. Elevate your trading strategy and align yourself with the forces shaping the market landscape.

The system works

Market Analysis and Stock Picks

We record two free YouTube videos each week that start with a review of the prior “pick of the day” and evaluate the trade, then conduct market analysis using Option Stalker Pro to find a new “pick of the day”. Click below to view recent videos.

How To Get Started:

Learn The System

Our trading system is your path to clarity and the Start Here section of our website will quickly get you up to speed. Each resource is an important building block. When you have reviewed the materials you’ll understand what the system is, why it works and the tools we use to find opportunities. The effort you put into learning the system and the tools is critical. Don’t rush the process. Armed with knowledge, you’ll be ready to see the system in action.

Meet The Traders

It’s time to register for the Free Trial. The action will be fast and furious. You’ve studied the patterns so you’ll understand the basis for each trade posted in the chat room. You’ll have access to Option Stalker Pro. It has an incredibly powerful search engine and is the source of all of our trade ideas. The two-week trial will fly by so please make sure that you are prepared. We want you to maximize it.

Join Us

You are going to learn more than you can imagine in a very short period of time. The traders you meet during the free trial started right where you are now. You’ll see them enter and exit great trades with ease and they are living proof that this system can be learned and replicate. We’re confident you’ll want to join our team and we’ll help you find the product that suits your needs.

The best way to get started is to read through the entire website. We’ve included an incredible amount of educational content to teach our systematic approach. You’ll know what it is, why it works and how our tools help you exploit the edge that we trade. The Start Here section will lead you through the process step-by-step.

I have to answer this question with a question. Do you trust track records? We don’t because many of these so-called track records are “cherry-picked.” We offer many ways for you to check our performance.

- During your free trial ask members in the chat room if they are making money. We don’t mind if you do this and we won’t interfere when members respond.

- Watch the trades in the chat room during the free trial.

- Watch the YouTube videos. In each daily video we recap the trades highlighted in the prior video. Go back weeks or months and watch those videos. In fact, check the YouTube videos that were posted during the biggest market crash since the Great Depression

We don’t want to win you over with old trades. We want to show you how we are making money today. That’s why we offer a free two-week trial. Visit Start Here to learn how to begin.

You will find a detailed comparison of our products and features on the Pricing Page.

We suggest starting with a shorter term subscription because we do not offer refunds. If you like our trading technology after using it for a month or two, subscribe to a longer term and save money. The days you have left on the old subscription will be added to the new subscription.

Visit the product pages for Chat Room, Option Stalker, and Option Stalker Pro. They describe everything you need to know to get started using our tools. Additionally, please visit the Pricing Page for a side-by-side feature comparison. Option Stalker Pro is our flagship product and we suggest you read it’s dedicated page and manual carefully to understand it and the system we trade. Together, we highlight all of the features and describe the searches and when to use them and it explains the search variables offered in Custom Search.

In short, if you are an active trader you will want Option Stalker Pro.

Yes. We have an extensive library of articles located under The Edge in the top menu. You can find step-by-step instructions on how to explore our website in the Start Here page. Please begin with Our Trading Methodology. We suggest that you read as many of these articles as possible. Some of them are available to the public and some are only available to paid members. You will also find educational videos and our eBook. Annotated charts are posted to the chat room to highlight specific trading patterns. In short, everything OneOption touches has an element of education.

Learn The System

Start With OneOption, free.

Start Free TrialNo subscriptions. No annual fees. No lock-ins.